1. General Luxembourg Tax Information

The below provides some basic information on Luxembourg personal taxes. It is intended to give general guidance to individuals regarding the Luxembourg tax system but will not cover all eventualities and it is recommended that you contact us for advice on your specific situation. The information is based on the relevant legislation at 1 January 2019 and may be subject to change.

1.1 Tax Year

Luxembourg follows a calendar year basis for income taxes so the tax year runs from 1 January to 31 December.

1.2 Scope of Taxation

“Luxembourg residents must report their worldwide income on the Luxembourg tax return. This is particularly relevant for US citizens who remain taxable on their worldwide income in the US and need to utilise the terms of the tax treaty to avoid double taxation.”

Luxembourg residents (see section 1.6) must report their worldwide income on the Luxembourg tax return. In cases where income is taxable in another country, treaty relief may be available but this depends on personal circumstances and so should be reviewed on a case-by-case basis. This is particularly relevant for US citizens who remain taxable on their worldwide income in the US and need to utilise the terms of the tax treaty to avoid double taxation.

Luxembourg non-residents are taxable on their Luxembourg sourced income. If they meet certain criteria, non-residents can elect to be treated as residents for tax purposes giving access to all available deductions.

1.3 Basis of Taxation

Luxembourg has 8 categories of taxable income for personal tax purposes:-

Agriculture & Forestry (see section 2)

Independent professions, including directors fees (see section 2)

Income from trade or business (see section 2)

Employment income (see section 3)

Investment income (interest/dividends) (see section 4)

Pension income (see section 5)

Rental income (see section 6)

Miscellaneous income, including capital gains (see section 7)

Within each category of income, the gross amount received is reduced by allowable expenses to arrive at the net income per category. Any income not falling into one of the above categories is not taxable (e.g. lottery winnings). The net income from each category is aggregated (in most cases, losses from one category can offset income from another category) to arrive at the adjusted gross income (AGI). Before calculating the tax, it is possible to claim certain deductions and extraordinary expenses against the AGI to arrive at the taxable income (see section 8).

1.4 Tax rates

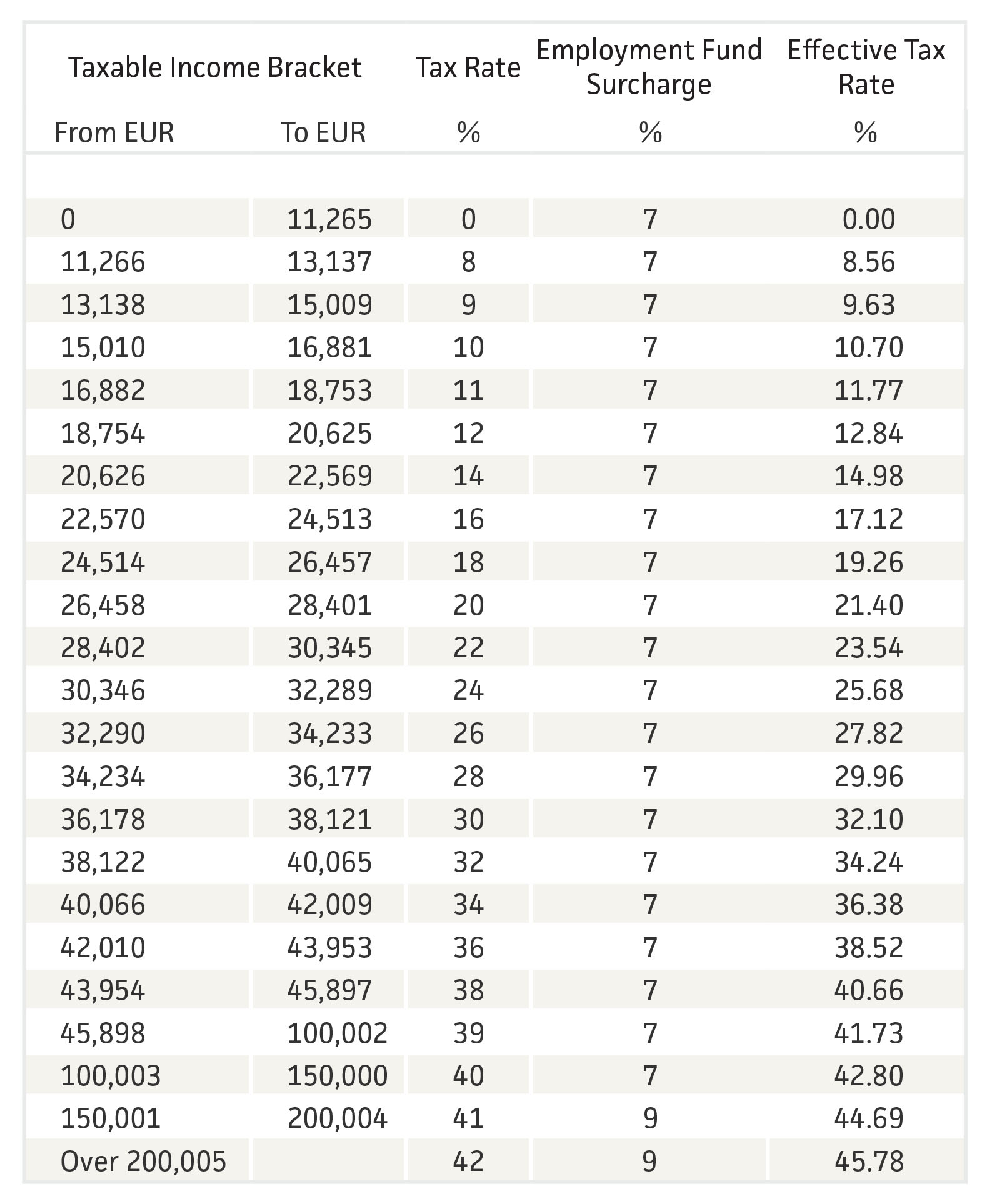

Luxembourg operates a progressive tax rate system with tax rates ranging from 0% to 42%. An Employment Fund Surcharge of either 7% or 9% is calculated on the final tax bringing the overall effective tax rates up to 45.78%.

The 2022 tax rates are:-

“Luxembourg operates a progressive tax rate system. An Employment Fund Surcharge is calculated on the final tax bringing the overall effective tax rates up to 45.78%. ”

1.5 Dependence insurance/tax balancing contribution

In addition to the basic tax, individuals are required to pay a 1.4% contribution for dependence insurance. These contributions are withheld from employment and pension income with social security contributions. Contributions due on other income are paid via the tax return.

1.6 Residency

An individual is resident from their date of arrival in Luxembourg if they:-

a) have a permanent place of residence in Luxembourg and they use and maintain this residence;

b) have continuous presence in Luxembourg for 6 months, excluding short absences.

Where an individual is resident in Luxembourg and in another country, it may be necessary to look at any tax treaties in existence between the relevant countries to determine the treaty-residence position of the individual. An individual is non-resident in Luxembourg if they do not meet one of the above conditions for residency.

1.7 Joint taxation

Resident taxpayers who are married are, in most cases, taxed jointly so their combined income is reported on a single tax return. Registered civil partners can elect to be taxed jointly as long as certain conditions are met. From 1 January 2018, it is possible to elect for separate taxation, although joint taxation remains the default position, including in the year of marriage or divorce.

Non-resident taxpayers who are married or cases where one spouse is resident and the other is non-resident do not automatically file jointly although joint filing is possible by election if certain conditions are met.

1.8 Tax Classes

The tax class applied to a resident depends on their personal situation:-

Tax Class 1: single persons

Tax Class 2: married persons (& civil partners upon request)

Tax Class 1A: single persons with children / taxpayers over 64 year old at the start of the year

In the event of divorce, each party may be able to benefit from Tax Class 2 for a limited period of time post-divorce. Similarly, in the case of death of a spouse, the surviving spouse may be able to benefit from Tax Class 2 for a limited period of time post-death.

From 1 January 2018, the default tax class for a non-resident taxpayer is Tax Class 1. Tax Class 2 can be requested in specific cases where certain conditions are met.

1.9 Tax cards

The tax card details the Tax Class and certain deductions that are applied through payroll and are issued automatically by the tax office.

Where individuals have multiple employments (including cases where both spouses are employed and have not elected for separate filing) only one “primary” tax card is issued. All other tax cards are “secondary” tax cards and apply a fixed tax withholding rate of 33% (Tax class 1) and 15% (Tax Class 2). For many taxpayers this can result in a tax liability due at the year-end as the overall taxes withheld are often insufficient. Care should be taken as the taxes due with the tax return at the year-end can be significant.

Where resident taxpayers elect for separate filing, and where non-residents request tax class 2, a formal request must be submitted to facilitate the change on the tax cards.

“...where both spouses are employed only one “primary” tax card is issued. For many taxpayers this can result in a tax liability due at the year-end.”

2. Entrepreneurial income

Income from self-employment is categorised as agricultural income, business income or independent income depending on the nature of the activities. Tax and social security is paid on an estimated basis during the year and reconciled through the tax return filing process.

2.1 Director’s fees

Director’s fees are subject to a 20% withholding tax. In certain cases, this withholding tax can be considered final.

2.2 Gross turnover exceeding €100,000

Taxpayers with gross turnover exceeding €100,000 are required to keep accounting records and to prepare financial statements.

3. Investment income

Investment income typically includes interest and dividends received.

3.1 Interest

Interest received by a Luxembourg resident from a Luxembourg entity is subject to a 20% withholding tax which is the final tax on this income. Interest income falling outside the 20% regime is taxable via the tax return at marginal tax rates.

In certain cases, Luxembourg residents can request for the 20% taxation to extend to interest income paid by entities from EU member states. There are some strict rules regarding timing of the request so advice should be sought.

3.2 Dividends

Dividends paid by Luxembourg resident companies have a 15% tax withheld at source. Dividends are taxed at marginal tax rates although 50% of dividends received from certain EU resident companies as well as companies resident in countries where Luxembourg has a tax treaty are exempt.

Costs incurred in relation to the obtaining investment income can be deducted, with a minimum deduction of €25 available to each taxpayer. The first €1,500 of net investment income is tax exempt i.e. €3,000 for individuals filing jointly.

4. Employment income

Income from employment, including benefits in kind, are taxable when the payment/benefit is received.

4.1 Benefits in kind

Some typical benefits provided in Luxembourg are calculated using specific valuations:-

4.1.1 Company cars & bicycles

The benefit is calculated as 0.5 - 1.8% of the purchase price of the car per month depending on carbon emission and fuel type. The benefit on a bicycle is 0%.

4.1.2 Accommodation

Unfurnished accommodation is calculated at 75% of the rent per month. Furnished accommodation is calculated at an additional 10% per month.

4.1.3 Luncheon vouchers

Typically 18 vouchers per month are provided at a face value of €10.80 each. The employee generally funds ~25% of the value of the vouchers (i.e. €2.80 per voucher) from their net pay.

4.1.4 Interest subsidy

Some employers offer a scheme where they subsidise mortgage interest/personal loan interest paid during the year up to certain limits and these payments are exempt from tax and social security.

4.1.5 Stock options/grants/awards

The taxation of stock obtained via company share plans will vary depending on the type of plan involved. Care should be taken as tax liabilities could arise in Luxembourg for taxpayers who have left the country as a result of share options held via employer plans during their period of residence. It is recommended that taxpayers seek advice in this area to ensure the correct tax treatment is applied.

4.2 Expenses

A deduction can be taken for business expenses that were not reimbursed by the employer, with a minimum deduction of €540 applying to all taxpayers.

A deduction for commuting costs is available depending on the distance between the taxpayer’s home and work if the distance is greater than 4km. The distances are determined by the State and available up to a maximum distance of 30km. The deduction available is €99/km giving a maximum possible deduction of €2,574.

4.3 Withholding taxes

Monthly withholding taxes (based on the tax card) are deducted from gross income alongside social security deductions and dependence insurance.

4.4 Inpatriate tax regime

The regime applies to individuals recruited abroad or individuals who are seconded to Luxembourg as part of an international group. There are a number of conditions that apply to both the employing company and the individual that have to be met in order for the regime to apply.

Benefits available under the regime can be significant as tax relief is available on a variety of payments made by the employer including relocation, school fees, housing, cost of living allowances, home leave trips and tax equalisation. There are limits applied to the reliefs available, but the regime can be beneficial where the qualifying criteria are met.

5. Pension income

State pensions and employer pensions are subject to tax withholding in the same way as employment income. Private pensions are taxable via the tax return to the extent that they are deductible for the payer.

Alimony received from an ex-spouse that qualifies for a tax deduction for the payer (see section 8) is taxed as pension income.

6. Rental income

“Rental income from both Luxembourg and foreign property is reported on the Luxembourg tax return.”

Rental income from both Luxembourg and foreign property is reported on the Luxembourg tax return. Standard expenses are allowable against the rental income (e.g. management fees, mortgage interest, repairs, maintenance etc.). The law also allows for a depreciation deduction ranging from 2% - 6% of the purchase price of the property, depending on the age of the property.

6.1 Mortgage interest

Mortgage interest paid on your principle residence is deductible against a nominal rental value determined by the State. Deductions are limited to €2,000 per member of the household for the first 6 years that you own the property following which the available deduction decreases with time.

7. Miscellaneous income

This captures various income not covered by other categories, the main income being capital gains.

7.1 Short term gains

These include immovable property that has been held for less than 2 years, movable property held less than 6 months and cases where the sale precedes the purchase of the asset. Short term gains and losses can be aggregated and the net income is taxed at marginal tax rates where it exceeds €500 in total.

7.2 Long term gains

These include immovable property held for more than 2 years and movable property held more than 6 months if there is a substantial participation i.e. the taxpayer owns directly or indirectly more than 10% of the share capital. Movable property held for more than 6 months where there is no substantial participation is not taxable.

Long term gains are taxable at 50% of the taxpayers overall tax rate and there are exemptions that can apply in certain cases. In general, the first €50,000 of gains made in an 11 year period are exempt. Short term and long term gains and losses can be aggregated although an overall loss cannot be offset against other income. In most cases, the sale of a principal residence is tax exempt although certain conditions need to be met.

8. Tax allowances/deductions/credits

There are various allowances and deductions that can be taken against taxable income as well as credits that can be offset against the tax liability. Deductions for non-resident taxpayers are limited. The main deductions and credits available to residents are:-

8.1 Alimony

A deduction up to €24,000 is available where support is provided to an ex-spouse. To the extent it is deductible for the paying spouse, it is taxable for the receiving spouse (see section 5).

“There are various allowances and deductions that can be taken against taxable income as well as credits that can be offset against the tax liability. Deductions for non-resident taxpayers are limited.”

8.2 Insurances & Debit interest

Interest paid on private loans, credit cards, bank accounts and premiums paid for life, medical, death, disability and 3rd party liability insurance can be deducted up to €672 per member of the household. There are conditions attached to some policies concluded outside Luxembourg. In certain instances, it is possible to claim an additional deduction for a lump sum payment to a life insurance policy.

8.3 Private pension

Contributions to private pensions are deductible up to certain age-dependent limits of €3,200 per year. There are conditions that must be met by the pension scheme.

8.4 Home saving scheme

Selected institutions in Luxembourg offer an approved savings scheme to encourage people to save to purchase a home. Contributions are deductible up to €672 per member of the household. This limit is doubled to €1,344 for taxpayers aged 18-40 at the start of the tax year.

8.5 Charitable donations

Donations to charities recognised by the Luxembourg tax authorities of at least €120 can be deducted with an upper limit of 20% of net income/€1,000,000.

8.6 Social security

Luxembourg social security premiums are deductible in full, excluding contributions for dependence insurance. Foreign contributions can also be deducted where they are paid in a country where Luxembourg has a social security agreement.

8.7 Occupational pension

Contributions of up to €1,200 per year are deductible. This deduction is reported on your tax return, but has been accounted for through the Luxembourg payroll.

8.8 Childcare/household employee

A deduction of up to €450 per month is available against costs incurred in either childcare (e.g. crèche, nanny, nurseries etc.) and/or registered household staff who undertake domestic work inside the house (e.g. cleaner).

8.9 Children living outside the household

An annual deduction up to €4,020 is available where the taxpayer provides more than 50% of the support to children living outside of their household.

8.10 e-car or e-bike

A deduction of €300 / €5,000 is available for the purchase of a new e-bike / e-car (removed from 1/1/2021)

8.11 Extra-professional allowance

For jointly taxed couples who are both working, an allowance of up to €4,500 can be claimed against taxable income. This is normally included in the second spouse’s payroll.

8.12 Extraordinary expenses

Where significant unavoidable expenses are incurred (e.g. unreimbursed medical costs, significant childcare/housekeeping costs etc.) that are in excess of “reasonable” expenditure an additional deduction can be taken as an extraordinary expense. Reasonable expenditure is calculated based on family size, income level and tax class.

8.13 Child tax credit

For most people this is paid monthly directly into your bank account. However, in cases where individuals do not have the right to claim the monthly payment, the credit can be claimed via the tax return. The current annual amount, per child, is €922.50.

8.14 Single parent

A single parent can claim a tax credit up to €1,500 subject to conditions.

8.15 Self-employed tax credit

A credit of up to €600 can be claimed via the tax return. A similar credit exists for employed/pension earners but this is normally claimed via the payroll process.

8.16 Foreign tax credits

Where income is subject to tax in a foreign jurisdiction, a credit may be possible in Luxembourg to ensure no double taxation.

9. Tax returns

Filing an income tax return is not always mandatory. If you do not meet the mandatory filing obligations, it is possible to file a voluntary return to claim a refund of withholding taxes.

9.1 Mandatory filing

Residents are required to file if they meet one of the following criteria:-

“Filing an income tax return is not always mandatory. If you do not meet the mandatory filing obligations, it is possible to file a voluntary return to claim a refund of withholding taxes.”

Taxable income includes salary/pension income that has been subject to withholding tax and exceeds €100,000

For instances of multiple income (e.g. 2 working spouses or multiple employments) the limit is reduced to €36,000 for taxpayers in Tax Class 1 or 2 and €30,000 for taxpayers in Tax Class 1a.

If no withholding tax has been levied on employment/pension income

If net income not subject to withholding taxes exceeds €600 (includes rental income)

If investment income subject to withholding tax exceeds €1,500

Directors fees in excess of €1,500

If spouse is non-resident and they request joint filing.

Non-residents are required to file if the meet one of the following criteria:-

Taxable income exceeds €100,000

For instances of multiple income in Luxembourg (e.g. 2 working spouses or multiple employments) the limit is reduced to €36,000 for taxpayers in Tax Class 1 or 2 and €30,000 for taxpayers in Tax Class 1a.

Luxembourg professional income over €100 that has not been subject to withholding tax

Directors fees in excess of €100,000

9.2 Voluntary filing

A voluntary filing can be submitted to obtain a refund of withholding taxes where taxpayers do not qualify for mandatory filing. In most cases worldwide income should be reported, however, if individuals were working in Luxembourg for at least 9 months and/or at least 75% of their professional income arose in Luxembourg it may be possible to report solely the Luxembourg income.

9.3 Tax filing process

The filing deadline for the mandatory return is 31 March following the end of the tax year. Currently, late filing of a few months is not penalised, but this practice could change in the future.

Once submitted, the tax authorities will issue a tax assessment which details the tax due or refund payable. Upon receipt of the assessment the taxpayer has 30 days to pay the tax due and 3 months to appeal against the assessment and receive a new assessment, if they believe there is an error in the tax authorities’ calculation.

The voluntary filing must be submitted by 31 December following the end of the tax year. Late submissions will not be accepted. Historically, no assessments were issued in respect of voluntary filings but this practice is changing with assessments being issued in some cases – refunds are deposited direct to the taxpayer’s bank account.

Have a question?

If you have any questions please feel free to contact us directly.